How To Get The Stimulus Check On Your Tax Return Turbotax

The IRS has indicated theres nothing you can do to change where they send. It would be advantageous to get the 2020 return in soon if you.

Credit Karma Tax vs TurboTax.

How to get the stimulus check on your tax return turbotax. Of course theres still time for your stimulus check to. You can check the status of your payment with the IRS Get My Payment tool. Taxpayers with direct deposit information on file will receive the payment that way.

TurboTax and HR Block Used Unfair and Abusive Practices State Regulator Finds. On another persons 2018 or 2019 tax return will be able to get their stimulus money if they. The tool should tell you where your stimulus payment was.

Under the current proposal before Congress eligibility and stimulus check amounts would be based on either your 2019 or 2020 return. Then youll have to claim the Recovery Rebate Credit on your 2020 tax return. TurboTax will guide you through.

Simply enter your information and the TurboTax e-File Status Lookup Tool gives you the status on your IRS federal tax return instantly. Please let everyone know that you can. TurboTax Has You Covered.

Those who received the correct amount for both relief payments will not have to complete the rebate credit on your upcoming tax returns. Check the IRS Get My Payment tool. If you meet the requirements youll see a It looks like you qualified for the stimulus did you get any payments.

Dont worry about knowing these tax rules. Many TurboTax users wondering why the program asks customers about stimulus checks. Plus get answers to other big stimulus check questions.

Enter all of your federal return information as you would normally. The IRS has begun issuing stimulus payments using the most recent information they have on file likely from your 2019 tax return either by direct deposit or by check. Yes if you did not receive the additional 500 per qualifying child in your first stimulus check or the additional 600 per qualifying child in your second stimulus check you can claim the additional stimulus amounts in the form of a Recovery Rebate Credit.

TurboTax said in a blog post that customers receiving a. If your 2020 tax return isnt filed and processed by the IRS. Your stimulus check is formally called a Recovery Rebate Credit.

If you had a baby in 2020 its time to claim your missing stimulus check. And remember anyone who earned more than 80000 in 2019 or 2020 wont be eligible for a stimulus check at all. Economic stimulus payments for COVID-19 relief are adding another layer to tax preparation this year.

Did TurboTax Rip You Off. Check the e-file status of your federal tax refund and get the latest information on your federal tax return. If your tax return doesnt indicate a direct deposit account youll receive a paper check.

During the Federal Review well check if you meet eligibility requirements for the stimulus payment. If you are a nonfiler and would otherwise not be required to file a tax return according to the IRS you will need to file a Form 1040 or Form 1040-SR to claim stimulus payments if you are eligible in the form of a Recovery Rebate Credit. What you need to know when you file your 2020 tax return.

The IRS will use your adjusted gross income information in the latest tax return filed 2018 or 2019 to determine the amount of your stimulus payment and will deposit your stimulus payment based on the latest direct deposit information. If you were eligible for the first or second stimulus payment but did not receive the full amount you qualify for youll be able to get the missing funds as a tax credit when you file your 2020 taxes. Whether you get a stimulus check or not relies heavily on your taxes even if you dont file at all.

Stimulus checks and your taxes. Parents of 2020 babies might get an extra 1100 stimulus check. The House version of the stimulus bill directs the US Treasury to issue the checks based on a taxpayers 2020 or 2019 tax return.

The deadline for filing your 2020 tax return is April 15. Please please please do not pay Turbo Tax if you make below 39000 even if your return isnt simple Find the link to TurboTax Free File program here. There is nothing you need to do to get a stimulus payment.

Dont worry about knowing these tax provisions.

What Is A Recovery Rebate Credit Here S What To Do If You Haven T Received Your Second Stimulus Payment From The Irs Abc7 New York

What Is A Recovery Rebate Credit Here S What To Do If You Haven T Received Your Second Stimulus Payment From The Irs Abc7 New York

How To Get A Copy Of Your Tax Return Or Transcript The Turbotax Blog

How To Get A Copy Of Your Tax Return Or Transcript The Turbotax Blog

Covid 19 Stimulus Checks Turbotax Offers Way To Get Checks Heavy Com

Covid 19 Stimulus Checks Turbotax Offers Way To Get Checks Heavy Com

Where Is Your Stimulus Check If You Filed Taxes With H R Block Or Turbotax

Where Is Your Stimulus Check If You Filed Taxes With H R Block Or Turbotax

Coronavirus How To Use Turbotax To Get Stimulus Checks Faster As Com

Coronavirus How To Use Turbotax To Get Stimulus Checks Faster As Com

How To Check Your Tax Refund Status Turbotax Tax Tips Videos

How To Check Your Tax Refund Status Turbotax Tax Tips Videos

Why Haven T I Received My Second Stimulus Check The Turbotax Blog

Why Haven T I Received My Second Stimulus Check The Turbotax Blog

What You Need To Know About Your 2020 Stimulus Check Turbotax Tax Tips Videos

What You Need To Know About Your 2020 Stimulus Check Turbotax Tax Tips Videos

Where S My Second Stimulus Check Turbotax Tax Tips Videos

Where S My Second Stimulus Check Turbotax Tax Tips Videos

Turbotax Irs Launch Online Portal For Stimulus Check Direct Deposit

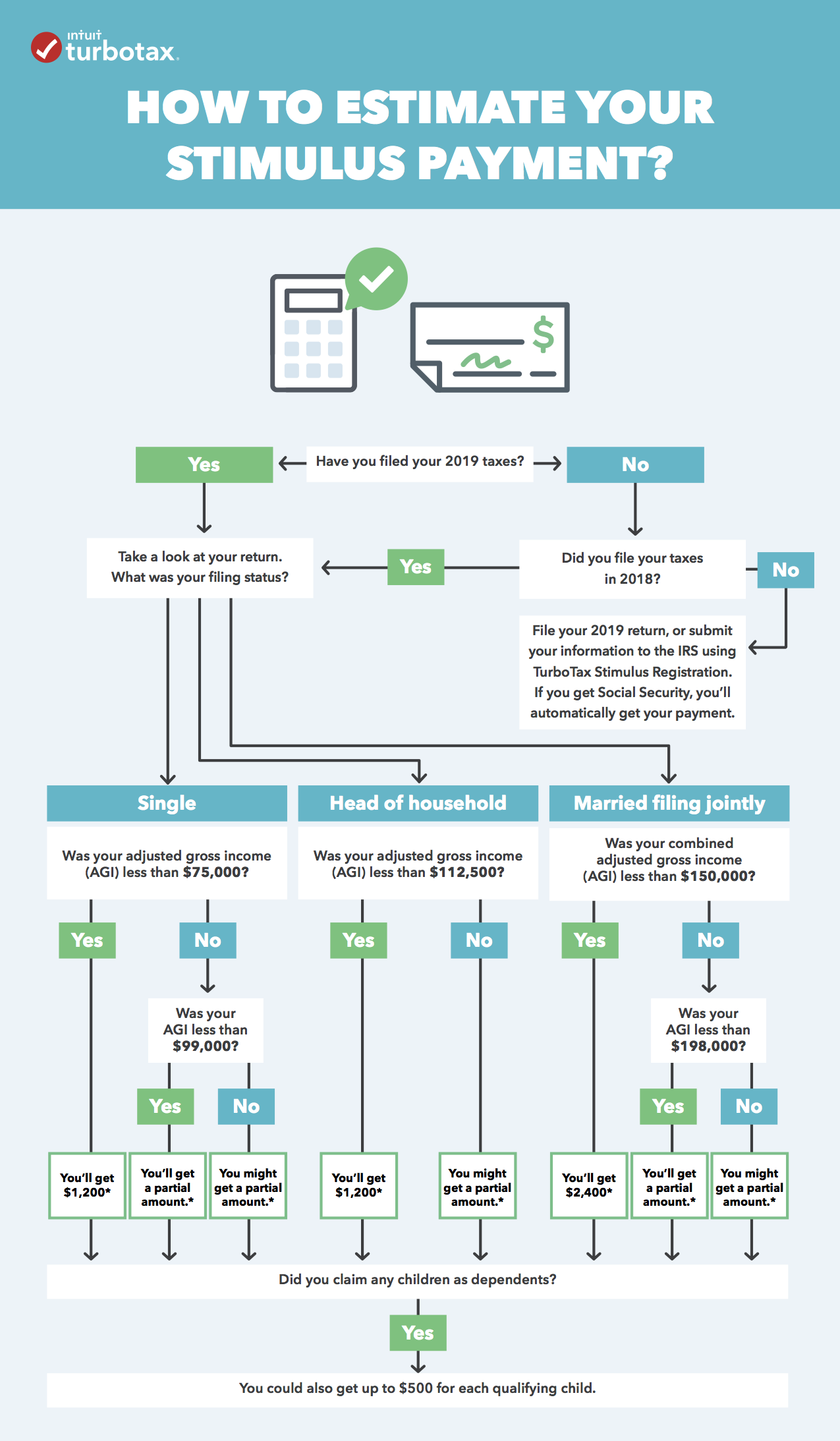

How To Estimate Your Stimulus Check Infographic The Turbotax Blog

How To Estimate Your Stimulus Check Infographic The Turbotax Blog

Turbotax To Help Millions Of Americans Get Their Stimulus Payments With Launch Of Free Stimulus Registration Product The Turbotax Blog

Turbotax To Help Millions Of Americans Get Their Stimulus Payments With Launch Of Free Stimulus Registration Product The Turbotax Blog

Turbotax H R Block Blame Irs For Stimulus Mix Up Youtube

Turbotax H R Block Blame Irs For Stimulus Mix Up Youtube

How Do I Activate Turbotax Live Purchased Through

How Do I Activate Turbotax Live Purchased Through

Does My Stimulus Check Affect My Taxes The Turbotax Blog

Does My Stimulus Check Affect My Taxes The Turbotax Blog

Turbotax Launched A Free Tool To Help Make Sure You Receive Your Stimulus Check

Turbotax Launched A Free Tool To Help Make Sure You Receive Your Stimulus Check

Post a Comment for "How To Get The Stimulus Check On Your Tax Return Turbotax"