How To Claim Stimulus Check On 2020 Tax Return

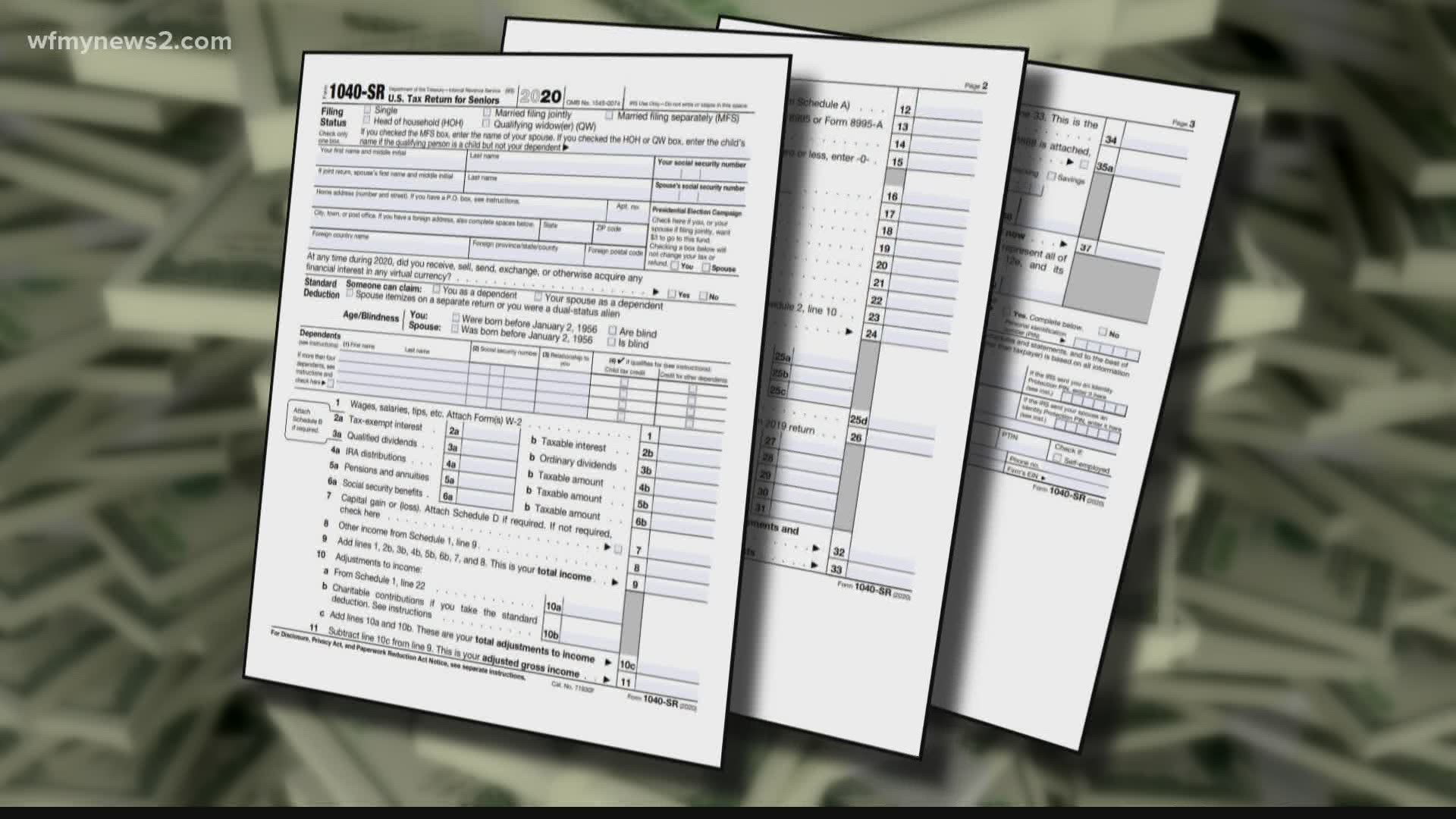

You need to file federal tax form 1040 or 1040-SR for 2020 to claim your Recovery Rebate Credit. As with nonfilers if you missed the deadline the IRS said you can claim the payment on your 2020 federal tax return this year by filing the 2020 Form 1040 or 1040-SR.

Look For Line 30 On Your 1040 To Claim Your Stimulus Payment The Washington Post

Look For Line 30 On Your 1040 To Claim Your Stimulus Payment The Washington Post

In some cases where parents are separated or divorced and share joint custody each parent can get a 500 or 600 payment per eligible child for the first and second checks.

How to claim stimulus check on 2020 tax return. Youll also need your IRS Notice 1444 the letter the IRS should have sent to you a few days after you got your first stimulus check and IRS Notice 1444-B which you would have gotten after your second stimulus check. A 2020 tax return is really the only vehicle that you have right now said Henry Grzes lead manager for tax practice and ethics with the American Institute of CPAs. How to claim missing stimulus check The IRS began collecting and processing 2020 tax returns 12 February a delay from the usual January 15 start.

Later in 2020 the IRS requested that people with questions about their stimulus check not call the agency. You can direct file your tax return through the IRS if you make less than 72000 a year. Unless the IRS mailed your check right at the deadline or your payment is caught up in a direct deposit holdup with tax preparers youll need to claim money from the 600 stimulus check as a.

Well give you the instructions you need. For TurboTax Live Full Service your tax expert will amend your 2020 tax return for you through 11302021. The IRS has made its Free File tool available to.

The IRS has made its Free File tool available. And if you didnt qualify for a check based on your past tax return you could get stimulus money if you file a tax return for 2020 that shows youre eligible. If for some reason you didnt get any stimulus payment last year but youre owed one you can get it this year when you file your 2020 tax return by claiming the Recovery Rebate Credit.

How to claim your lost stimulus check. If you dont get the full amount that you were entitled to in 2020 or 2021 you could also get that from your 2020 tax return. Terms and conditions may vary and are subject to change without notice.

As if taxes werent stressful enough the current income tax filing season marks the last call for 2020 stimulus check money. How to claim your stimulus check on your 2020 taxes When taxpayers file their 2020 taxes theyll be asked to report the total Economic Impact Payment they received in 2020 or early 2021 if your. To get the money youre owed look for the Recovery Rebate Credit.

If you still want to try however you can call the IRS help number at 800-829-1040 or. Between the first and second batches of 2020 stimulus checks the. CNET - If your first or second stimulus check never arrived or if any money for you or your dependents was missing nows the time to file for a Recovery Rebate Credit on your 2020 tax return.

You wont see stimulus checks or economic impact payment on your return. When you claim that credit on your 2020 return once tax season begins on Feb. The IRS began processing 2020 tax returns on Feb.

12 creating a delay from the usual Jan. But because of the urgency of the situation the IRS was. 12 the IRS will factor it into your overall tax return including liabilities.

The credit will be added to any refund or reduce the tax you owe on your 2020 return. Make changes to your 2020 tax return online for up to 3 years after it has been filed and accepted by the IRS through 10312023. This will be on line 30 of your 2020 Form 1040 or.

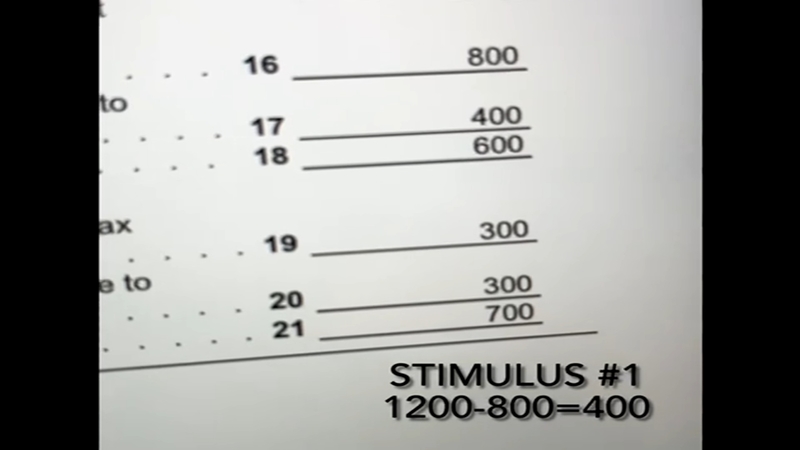

Both the first stimulus check and the second stimulus check are an advance on a temporary 2020 tax credit. If you think the IRS owes you stimulus money you can use a recovery rebate worksheet to calculate how much you should receive and claim that amount on Line 30 on your 2020 tax return. That means for instance if you.

Claim your missing stimulus check. Free File Alliance an IRS program that partners with private companies.

Payment Status Not Available Irs Says Some Won T Receive Second Stimulus Check Automatically Abc11 Raleigh Durham In 2021 Irs Sayings Goldsboro

Payment Status Not Available Irs Says Some Won T Receive Second Stimulus Check Automatically Abc11 Raleigh Durham In 2021 Irs Sayings Goldsboro

You Can Soon Claim 500 Missing Stimulus Money For Your Kids But You Have To Do Your Taxes First Missing Money Irs Filing Taxes

You Can Soon Claim 500 Missing Stimulus Money For Your Kids But You Have To Do Your Taxes First Missing Money Irs Filing Taxes

Missing A Stimulus Check Here S How To Claim Or Report It To The Irs In 2021 Irs Irs Website Missing Money

Missing A Stimulus Check Here S How To Claim Or Report It To The Irs In 2021 Irs Irs Website Missing Money

Wheres My Stimulus How To Redeem Payment With Irs Recovery Rebate Tax Credit Abc7 Chicago

Wheres My Stimulus How To Redeem Payment With Irs Recovery Rebate Tax Credit Abc7 Chicago

Stimulus Checks And Your Taxes What You Need To Know When You File Your 2020 Tax Return Cnet

Stimulus Checks And Your Taxes What You Need To Know When You File Your 2020 Tax Return Cnet

Claim Missing Stimulus Money On Your 2020 Tax Refund Asap Here S How Cnet

Claim Missing Stimulus Money On Your 2020 Tax Refund Asap Here S How Cnet

It S Finally Time To Claim Missing Stimulus Money On Your 2020 Refund Here S How Filing Taxes Rebates Income Tax Return

It S Finally Time To Claim Missing Stimulus Money On Your 2020 Refund Here S How Filing Taxes Rebates Income Tax Return

Ssdi And Ssi What To Know About Stimulus Check Eligibility Catch Up Payments More Social Security Disability Disability Insurance Filing Taxes

Ssdi And Ssi What To Know About Stimulus Check Eligibility Catch Up Payments More Social Security Disability Disability Insurance Filing Taxes

How To Claim Missing Stimulus Payments On Your 2020 Tax Return

How To Claim Missing Stimulus Payments On Your 2020 Tax Return

Didn T Get Your Stimulus Payments You Can Now Use Free File To Claim Them

Didn T Get Your Stimulus Payments You Can Now Use Free File To Claim Them

How To Claim The Stimulus Money On Your Tax Return Abc10 Com

How To Claim The Stimulus Money On Your Tax Return Abc10 Com

Stimulus Checks And Your Taxes What You Need To Know When You File Your 2020 Tax Return Cnet

Stimulus Checks And Your Taxes What You Need To Know When You File Your 2020 Tax Return Cnet

Second Stimulus Check Timeline When Could The Irs Possibly Send A New Payment To You In 2020 Irs Filing Taxes Payment Date

Second Stimulus Check Timeline When Could The Irs Possibly Send A New Payment To You In 2020 Irs Filing Taxes Payment Date

Irs Claim Your 1 200 Stimulus Check By November 21 Irs Student Loans Irs Website

Irs Claim Your 1 200 Stimulus Check By November 21 Irs Student Loans Irs Website

Filing Taxes To Claim Stimulus Money You Need Your Agi Here S What It Is And How To Find It Cnet

Filing Taxes To Claim Stimulus Money You Need Your Agi Here S What It Is And How To Find It Cnet

When Will I Get My 2020 Tax Refund Likely Dates And Irs Tracking Tools Cnet

When Will I Get My 2020 Tax Refund Likely Dates And Irs Tracking Tools Cnet

Post a Comment for "How To Claim Stimulus Check On 2020 Tax Return"