How To Invest In Hedge Funds In India

Hedge funds are traditionally more expensive than other pooled investment vehicles. Expense ratio can be 2 or below that as well and performance fee varies from 10 to 15 of the returns generated.

Best Mutual Funds To Invest In 2013 In India Infographic Mutuals Funds Fund Investing

Best Mutual Funds To Invest In 2013 In India Infographic Mutuals Funds Fund Investing

Securities And Exchange Board Of India Alternative Investment Funds Regulations 2012 mainly regulate the Hedge funds in India.

How to invest in hedge funds in india. And it is not just Tiger Global which has invested in 15 start-ups this year. 7 Best Fund of Funds in India 2021 Updated on February 24 2021 15770 views. A hedge fund is also called an alternative investment fund or AIF in India.

Hedge Funds in India. The Securities and Exchange Board of India SEBI issued the SEBI Alternative Investment Funds Regulations 2012 AIF Regulations on 21 May 2012 with a view to regulate the non-retail asset management segment on a comprehensive basis. A common hedge fund fee is two and 20 which means 2 per year of the assets that are being managed and another.

Only qualified or accredited investors can invest in hedge funds. Recently Avendus Capital has reported as the first domestic hedge fund to have 1 billion asset under management. 5 lakhs employees of the fund can invest lesser At least 23rd of the funds should be in unlisted equity shares Not suitable for a PE or hedge fund No buying into an NBFC Gold Financing and other such activities.

Constant reporting is necessary. The minimum amount required for investment in hedge funds in India is 1 crore. In India hedge funds are registered with SEBI under the Securities and Exchange Board of India Alternative Investment Funds Regulation 2012 AIF Regulation.

Alternative investment fund in India with securities and exchange Board of India SEBI. The minimum ticket size for investors investing in these funds is Rs 1 crore. The basic idea is to invest wherever the fund manager can spot an opportunity without being bound by strict rules which apply to mutual funds.

Hedge mutual funds pool money from larger investors like high networth individuals HNI endowments banks pension funds and commercial firms. AIFs were introduced in India in 2012 by Securities and Exchange Board of India SEBI in 2012 under the SEBI Alternative Investment Funds Regulations 2012. In India the categorization is under as Alternative Investment Funds AIF.

Slight lull but confidence increased again and we saw a lot of global investors in the form of Private Equity firms and Hedge Funds. Fund of funds is one of the Top Mutual Funds for investors whose investment amounts are not too large and it is easier to manage one fund a fund of funds rather than a number of Mutual FundsIn this form of mutual fund investment strategy investors get to hold a number of funds under the umbrella of a single fund. If you are a High Net Worth Individualinvestor who wants to invest above 1 Crore at once then hedge funds is one of the investment opportunities which are capable of delivering better returns in the long term.

A hedge fund is an alternative investment fund AIF which employs diverse or complex trading strategies and invests and trades in securities having diverse risks or complex products including listed and unlisted derivatives. The smart way to invest in hedge funds is to place your hedge fund allocations into the appropriate risk buckets in your portfolioso for example your longshort equity hedge funds belong in your. The funds regime in India is at a nascent stage therefore India is not considered as a hedge fund jurisdiction.

10 global PE firms and Hedge Funds investing in India. This pooled money is used to invest in such securities in national and international markets. Looking for the Best fund other than a mutual fund to invest in India for long-term Investment that may give better returns in comparison to mutual funds with minimum risk.

There is a separate regulatory regime for foreign hedge funds to invest in India as a foreign institutional investor. Many other hedge funds such as Falcon Edge Capital Steadview Capital Hillhouse Capital and Altimeter Capital have resumed investing in India. A QA guide to hedge funds law in India.

Hedge funds which led the start-up funding boom in 2015 are making a comeback after taking a pause for a few years. In this article we will discuss the process of hedge fund Registration in India ie. Hedge funds are a preferred choice as an investment vehicle globally for offering risk-adjusted returns and we are gaining broader acceptance in India among HNIs.

A hedge fund falls under Category III of the Alternative Investment Fund AIF in India. Risk-averse investors especially those who wish to ride on the upside of the market and at the same time wish to limit downside are keen to invest in hedge funds known as Category. Hedge fund industry is drawing media attention in India.

They fall under the AIF alternative investment funds-category III. However there is no such regulatory regime for hedge funds to be set up or marketed in India. A hedge fund doesnt require registration with SEBI and it doesnt have to disclose NAV periodically like a mutual fund.

In India there is no specific fee. To qualify as a hedge fund it should have a minimum corpus of INR 20 crore and a minimum investment of INR 1 crore from each investor. Hedge funds use aggressive strategies for achieving maximum returns with minimum risks.

There are the funds that invest in private equity fund currency venture capital options futures and real estate to name a few. They are mainly high net worth individuals HNIs banks insurance companies endowments and pension funds.

How To Invest In Mutual Funds Learn What Are Different Ways For Investing In Mutual Funds At Www Theinvestmentmania Investing Mutuals Funds Finance Investing

How To Invest In Mutual Funds Learn What Are Different Ways For Investing In Mutual Funds At Www Theinvestmentmania Investing Mutuals Funds Finance Investing

Mukesh Valabhji Most Common Investment Strategies In Private Equity Private Equity Refers To The Pro Private Equity Personal Fundraising Investing Strategy

Mukesh Valabhji Most Common Investment Strategies In Private Equity Private Equity Refers To The Pro Private Equity Personal Fundraising Investing Strategy

Hedge Fund Provided In India Hedges Hedge Fund Strategies Fund

Hedge Fund Provided In India Hedges Hedge Fund Strategies Fund

Mutual Fund Fees Infographic Mutuals Funds Finance Investing Hedge Fund Investing

Mutual Fund Fees Infographic Mutuals Funds Finance Investing Hedge Fund Investing

What Is A Balanced Mutual Fund Mutuals Funds Credit Score What Is Credit Score

What Is A Balanced Mutual Fund Mutuals Funds Credit Score What Is Credit Score

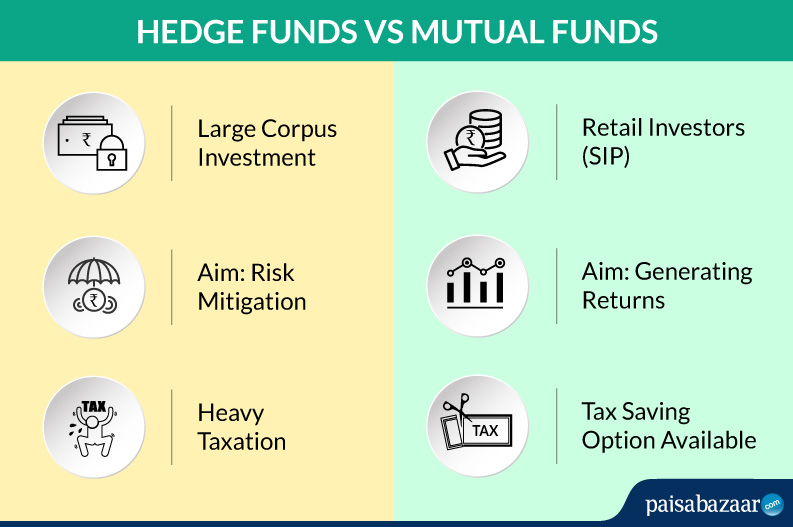

Hedge Funds In India Know Meaning Comparison With Mutual Funds

Hedge Funds In India Know Meaning Comparison With Mutual Funds

Fixed Deposit Vs Mutual Fund Infographic Investing Infographic Mutuals Funds Finance Investing

Fixed Deposit Vs Mutual Fund Infographic Investing Infographic Mutuals Funds Finance Investing

Option Trader S Hedge Fund Business Framework For Trading Equity Index Options

Option Trader S Hedge Fund Business Framework For Trading Equity Index Options

Hedge Funds Go On Attack In India Investment In India Investing India

Hedge Funds Go On Attack In India Investment In India Investing India

Other Than Asset Class How Else Can One Classify Mutual Funds Schemes Amfi Mutual Funds Investing Mutuals Funds Mutual Fund India

Other Than Asset Class How Else Can One Classify Mutual Funds Schemes Amfi Mutual Funds Investing Mutuals Funds Mutual Fund India

Cover Trail The Hedge Fund Myth Business Plan Example Hedge Fund Investing Finance Career

Cover Trail The Hedge Fund Myth Business Plan Example Hedge Fund Investing Finance Career

Hedge Fund Investing Fund Business Presentation

Hedge Fund Investing Fund Business Presentation

Arbitrage Services In India Arbitrageindia Hedgefundindia For More Details Visit Http Esteeadvisors Com Arbit Hedge Fund Strategies Stock Broker Investing

Arbitrage Services In India Arbitrageindia Hedgefundindia For More Details Visit Http Esteeadvisors Com Arbit Hedge Fund Strategies Stock Broker Investing

Pin By Navin Sahay On Investopedia In 2020 Hedge Fund Manager Investing Mutuals Funds

Pin By Navin Sahay On Investopedia In 2020 Hedge Fund Manager Investing Mutuals Funds

Mutual Fund Vs Hedge Fund All You Need To Know Finance Investing Mutuals Funds Investing Infographic

Mutual Fund Vs Hedge Fund All You Need To Know Finance Investing Mutuals Funds Investing Infographic

What Is A Hedge Fund What Are Hedge Funds Infographic Finance Investing What Is Hedge Fund Economics Lessons

What Is A Hedge Fund What Are Hedge Funds Infographic Finance Investing What Is Hedge Fund Economics Lessons

Here Are The Best Investment Options In India Such As Public Provident Fund Investing In A Mu Public Provident Fund Mutual Funds Investing Investment In India

Here Are The Best Investment Options In India Such As Public Provident Fund Investing In A Mu Public Provident Fund Mutual Funds Investing Investment In India

Mutual Funds Are One Of The Best Ways To Invest Any Amount Of Money You Have With Great Safety Mutuals Funds Mutual Fund India Mutual Funds Investing

Mutual Funds Are One Of The Best Ways To Invest Any Amount Of Money You Have With Great Safety Mutuals Funds Mutual Fund India Mutual Funds Investing

Post a Comment for "How To Invest In Hedge Funds In India"