How To Buy Stock Before Ipo Fidelity

The process that a company uses to sell its first shares to the public before the stock trades on any exchange at a price determined by the lead underwriter. An initial public offering is the first sale of shares on the stock market by a formerly private company.

Retail investors are usually stuck buying shares of IPOs after they begin trading and the price has typically popped.

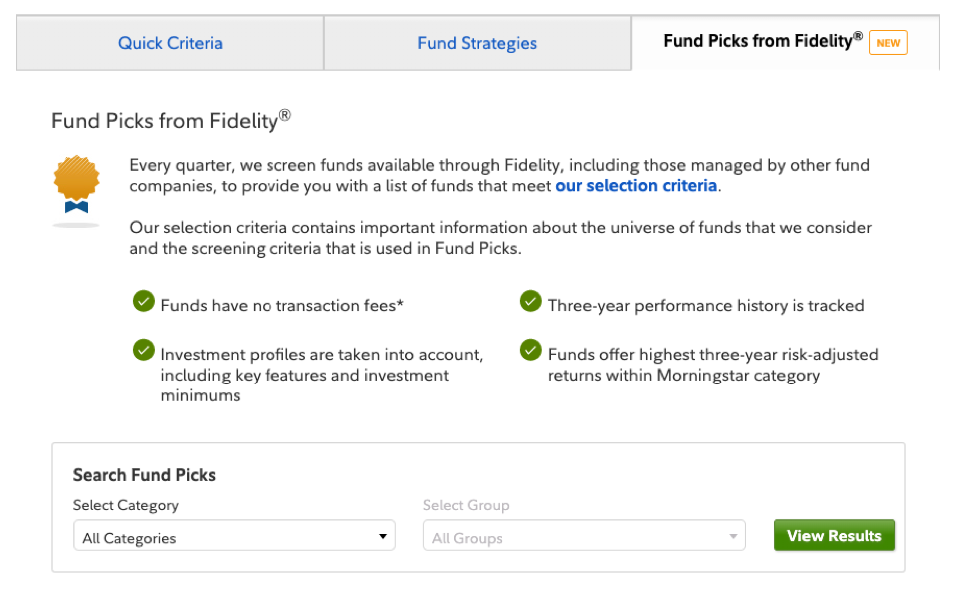

How to buy stock before ipo fidelity. For example requirements to participate in an IPO via Fidelity include having either 100000 or 500000 in retail assets depending on what companies are sponsoring the IPO. There will always be some element of rolling dice in SPAC investing and IPO investing. Submit a request to participate in the IPO when you get a notification that you can apply to buy shares go to IPO section of the platform you will see the IPO listing with the share price set by the underwriter click Participate in the IPO input the amount you want to invest Send your application.

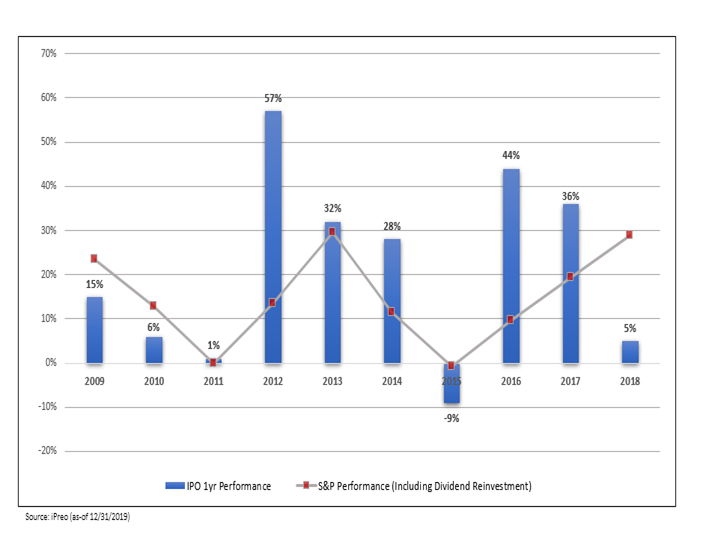

Prove eligibility TD Ameritrade will permit you to invest in an IPO if you have at least 250000 in assets with the firm or have traded stock with Ameritrade at least 30 times in the last 12. Beginners tutorial on how to set up a brokerage account and place your first stock mutual fund or ETF trade using Fidelity or most other brokerages. Lets look at how pre-IPO returns compare with the average stock market return.

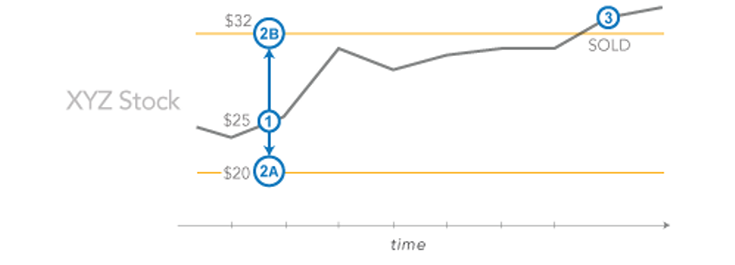

Being allocated shares at the offering price is referred to as participating in the IPO Participation in the IPO happens before the security is first traded on any of the stock markets. If you wouldnt buy the stock before you owned the SPAC there is no sense keeping it under the SPAC. Once the stock is listed shares can be purchased by the general public and existing investors can cash out at any time without the lock up period of traditional IPOs.

Once the company goes public and its stocks begin trading on the secondary market you can buy and sell them just as you would any other stock that you decide is right for you. Pre-IPO investments can lead to tremendous returns for investors. These banks and broker dealers allocate shares to institutional and individual investors.

7 Reasons You. Since the start of the stock market its historically returned an average of 10 annually. But its not uncommon for stocks to spike 80 90 or even 100 percent on.

Picking the stock to buy. If F-Prime controls 5 percent or more of a private companys voting stock then that ownership prevents the Fidelity mutual funds from buying the same security before or during an IPO according. The VCs who funded the startup since inception get to cash in the employees of the startup get to see their options not expire worthless and institutional investors get to buy pre-IPO shares before the first day of trading.

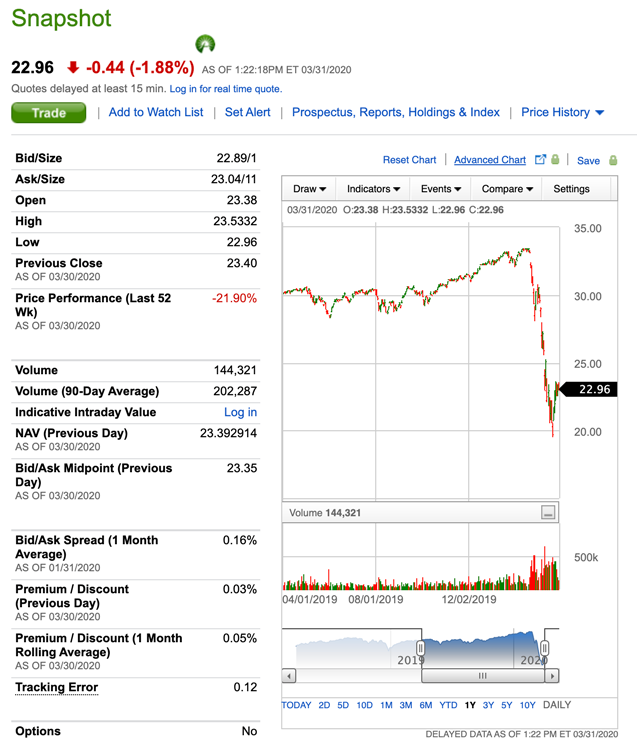

What you should know about IPOs. Throughout the process if youre ever stuck click the Help Me Trade button in the top left corner and Fidelity will guide you through the process. Remember that not all pre-IPO stocks work out so well.

Its when a company goes public Investing in an IPO is a lot like playing a video game you need to hit the right button at just the right moment. Log in to your account and select IPOs from the Trade tab or call 866-678-7233 for assistance. To buy the stock before the price is set you must be a professional investor or have a special relationship.

An issuance of stock by a company subsequent to its initial public offering. IPOs are always an exciting time. Investors can buy pre-IPO shares well below the IPO price before the stock actually trades on exchanges.

The first and biggest reason for pre-IPO investing is the gains. If you dont get in on the IPO on the ground floor so to speak you can always buy shares once the stock is trading. An alternative to buying the stock directly may be investing in one of a handful of mutual funds that invest in IPOs such as Renaissance Capitals Global IPO Plus Aftermarket.

Spotify is a recent example of a company that has opted to skip a traditional IPO process and instead list its shares directly on an exchange. Depending on your financial goals and the money you want to invest you can choose the number of shares you want to buy. The easiest way to decide this is by dividing your investment budget with.

Its risky to invest in pre-IPO. And unfortunately for most of us the right moment is before the actual IPO takes. IPO stock can be bought before or after the underwriting broker sets the opening price.

So heres how you buy a stock step-by-step with screenshots from Fidelity the brokerage that I use the process is similar at Vanguard and Schwab.

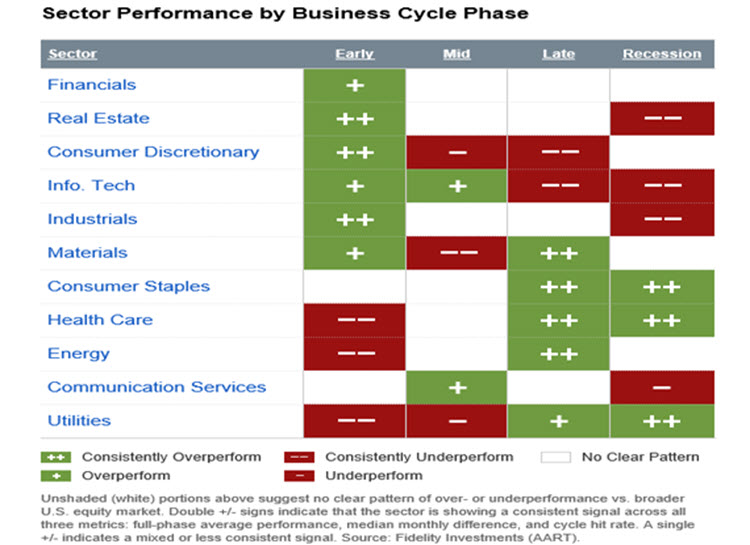

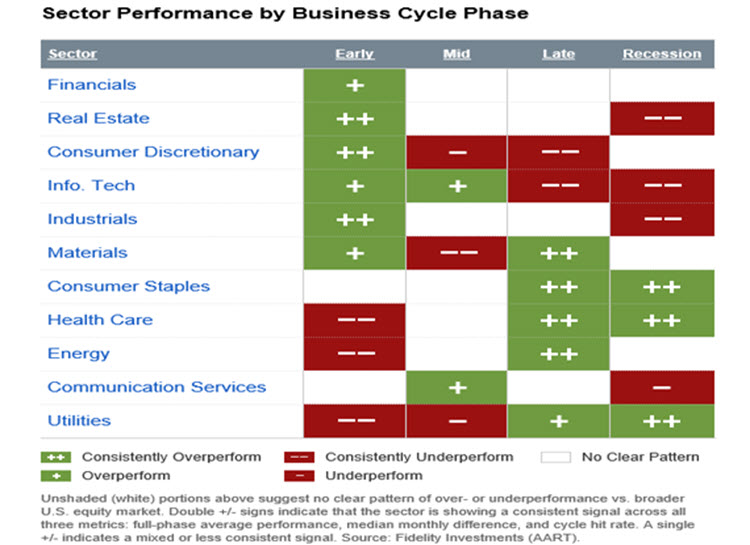

Large Cap Stocks Sector Rotation Fidelity Fidelity Stock Market Learning Centers

Large Cap Stocks Sector Rotation Fidelity Fidelity Stock Market Learning Centers

Fidelity Online Trading Investment With Lowest Expense Ratio U S Online Trading Investing Fidelity

Fidelity Online Trading Investment With Lowest Expense Ratio U S Online Trading Investing Fidelity

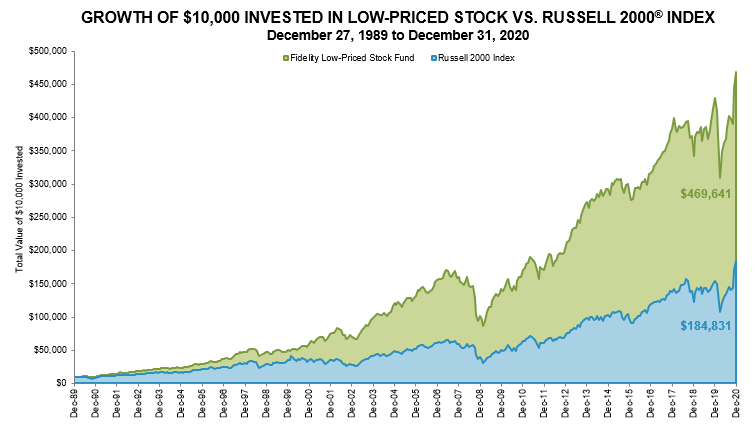

Fidelity Low Priced Stock Fund Flpsx

Fidelity Low Priced Stock Fund Flpsx

Fidelity Launches First Ever Zero Cost Index Funds Best Way To Invest Money Sense Investing Money

Fidelity Launches First Ever Zero Cost Index Funds Best Way To Invest Money Sense Investing Money

A Chart Shows The Historic Range Of P E Ratios Using Different Metrics While Some Measures Like Cape Appear Inflated Ot Us Stock Market Bond Market Us Bonds

A Chart Shows The Historic Range Of P E Ratios Using Different Metrics While Some Measures Like Cape Appear Inflated Ot Us Stock Market Bond Market Us Bonds

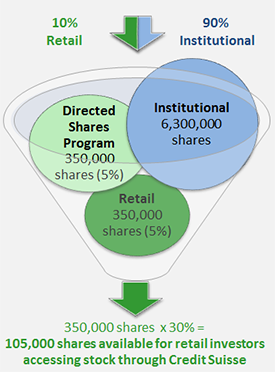

Ipo Share Allocation Process Fidelity

Ipo Share Allocation Process Fidelity

Investors Looking To Squeeze More Profit From The Next Bull Run Can Look To Fidelity Funds For Strong Active Management And Ta Fidelity Investing Mutuals Funds

Investors Looking To Squeeze More Profit From The Next Bull Run Can Look To Fidelity Funds For Strong Active Management And Ta Fidelity Investing Mutuals Funds

Trading A Step By Step Guide Fidelity

Trading A Step By Step Guide Fidelity

Sector Rotation Strategies Fidelity

Sector Rotation Strategies Fidelity

What Is The Best Mobile App For Share Market Stock Market Stock Market Training Stock Trading

What Is The Best Mobile App For Share Market Stock Market Stock Market Training Stock Trading

Contributing To Your Ira Fidelity

Contributing To Your Ira Fidelity

The Best Fidelity Funds For 401 K Retirement Savers Kiplinger Fidelity Savers Bond Funds

The Best Fidelity Funds For 401 K Retirement Savers Kiplinger Fidelity Savers Bond Funds

What Is A Conditional Order Fidelity

What Is A Conditional Order Fidelity

February 2019 Business Cycle Update Us Global Cycles Fidelity Investment Analysis Cycle Economic Research

February 2019 Business Cycle Update Us Global Cycles Fidelity Investment Analysis Cycle Economic Research

As Airbnb Plans 2020 Ipo A Reminder Of How Many Unicorns Still Need An Exit Https News Crunchbase Com News As Airbnb Venture Capital How To Plan Air B And B

As Airbnb Plans 2020 Ipo A Reminder Of How Many Unicorns Still Need An Exit Https News Crunchbase Com News As Airbnb Venture Capital How To Plan Air B And B

Stock Screeners Fund Comparison Tools From Fidelity

Stock Screeners Fund Comparison Tools From Fidelity

Post a Comment for "How To Buy Stock Before Ipo Fidelity"